Consolidation of CDSB

On November 3rd 2021 the IFRS Foundation announced that it would form a new International Sustainability Standards Board (ISSB), as well as the consolidation of the Climate Disclosure Standards Board and the Value Reporting Foundation (VRF—which houses the Integrated Reporting Framework and the SASB Standards) by June 2022.

The ISSB will develop, in the public interest, IFRS Sustainability Disclosure Standards that provide a global baseline of disclosure requirements designed to give investors high quality, globally comparable sustainability information that can be used by jurisdictions on a standalone basis or incorporated into requirements to meet broader, multi-stakeholder or public policy needs. This programme of work has been welcomed by the G20 Leaders and carries the support of market regulators, multilateral institutions, investors and companies worldwide.

The ISSB will work in close cooperation with the International Accounting Standards Board (IASB) to ensure connectivity and compatibility between IFRS Accounting Standards and IFRS Sustainability Disclosure Standards.

Climate Disclosure Standards Board

The Climate Disclosure Standards Board (CDSB) has now consolidated into the IFRS Foundation.

This consolidation confirms the closure of the CDSB and as it will be fully integrated into the ISSB, no further technical work or content will be produced. By joint agreement, CDSB’s resources remain accessible via this legacy website, which will be preserved until further notice.

CDSB was an international consortium of business, environmental and social NGOs, committed to advancing and aligning the global mainstream corporate reporting model to equate natural social capital with financial capital.

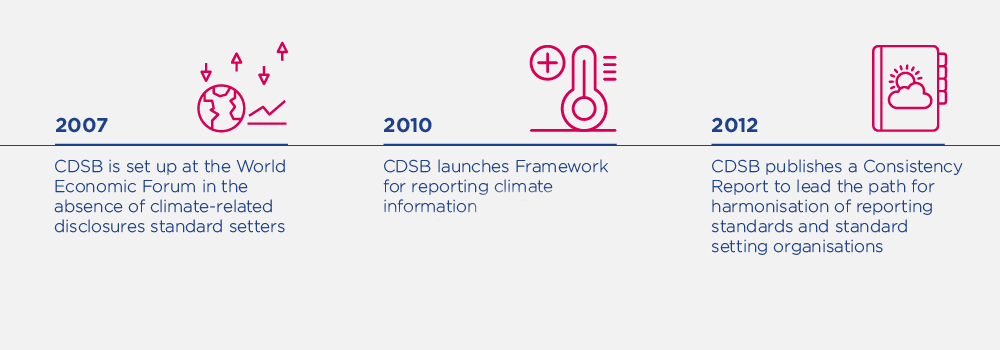

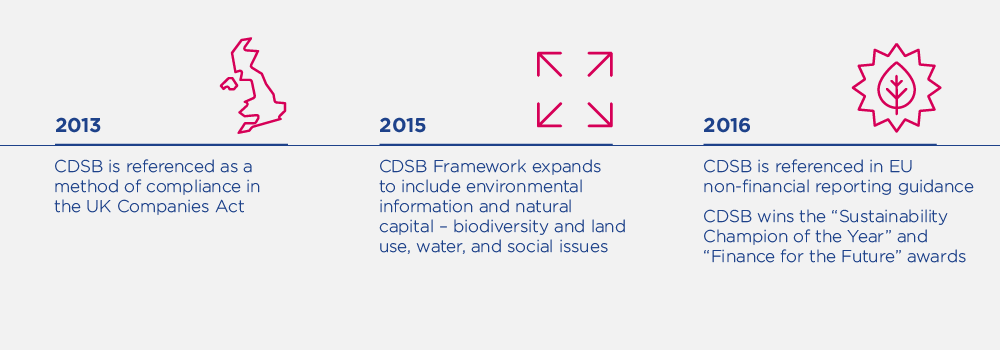

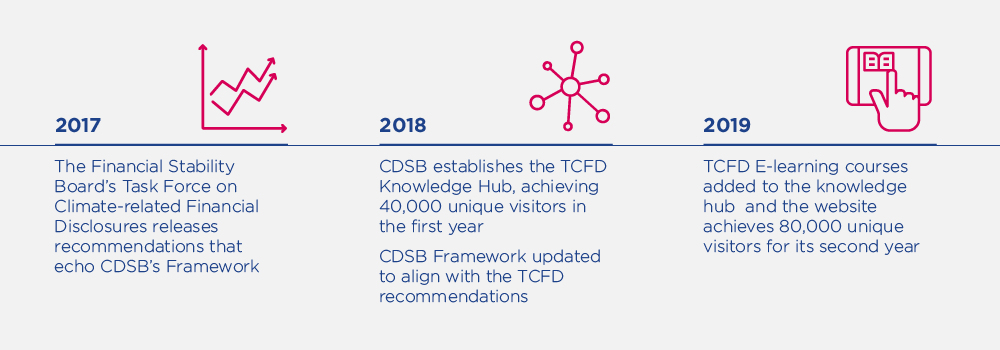

CDSB, created in 2007, did this by offering companies a framework for reporting environment and social information with the same rigour as financial information. The CDSB Framework formed a foundation for the Task Force for Climate-Related Financial Disclosures (TCFD) recommendations and sets out an approach for reporting environmental and social information in mainstream reports, such as annual reports, 10-K filing, or integrated reports. CDSB’s Framework for reporting environmental and social information and technical guidance on climate, water and biodiversity disclosures, as well as wider resources, will remain relevant and applicable for companies until such time as the International Sustainability Standards Board, a standards body of the IFRS, publishes its corresponding IFRS Sustainability Disclosure Standards on such topics.

For all future news and updates on sustainability standards, please visit the IFRS website.

CDSB technical guidance will form part of the evidence base as the ISSB develops its IFRS Sustainability Disclosure Standards. CDSB’s Framework and technical guidance on Water, Biodiversity and Social disclosures will remain useful for companies until such time as the ISSB issues its IFRS Sustainability Disclosure Standards on such topics.

CDSB technical work has not been subject to the IFRS Foundation’s due process, which the International Sustainability Standards Board will follow in its work, and does not form part of IFRS Standards.