Written by Mardi McBrien, Managing Director of CDSB

For those of you who feel like Dorothy, caught up in the tornado of climate and ESG related commitments, reports and announcements that fill our inboxes every day, the Financial Stability Board’s Taskforce Climate-related Financial Disclosures (TCFD) has today released the fourth iteration of its status report, providing the market with an update on progress adopting the requirements globally.

Download the status report here.

Notably this year, the TCFD have amended their recommendations for the first time since they were launched in June 2017 to include transition plans and more. These changes and the additional guidance also released today (Annex: Implementing the Recommendations of the Task Force on Climate-related Financial Disclosures, 2021 and Guidance on Metrics, Targets, and Transition Plans, 2021) are needed to support preparers, as we know only too well from the 100’s of questions CDSB receives via the TCFD Knowledge Hub and our TCFD-related engagement events every week.

Individual supporters of the TCFD have again grown, up more than 30 percent, now reaching over 2,600 organisations globally. Despite this huge growth in the last 12 months, I still find myself presenting to groups in G20 countries where there is a low to very low level of knowledge on the TCFD, to the point where I find myself having to explain the acronym. Encouragingly, the level of interest to learn more, improve and act continues to increase exponentially as the 100+ page report demonstrates in detail. We appreciate first hand that in the last 8 months alone we have had over 200,000 unique visits to the TCFD Knowledge Hub and over 10,000 completions of the TCFD eLearning educational courses available on the Hub. People are educating themselves and getting organised.

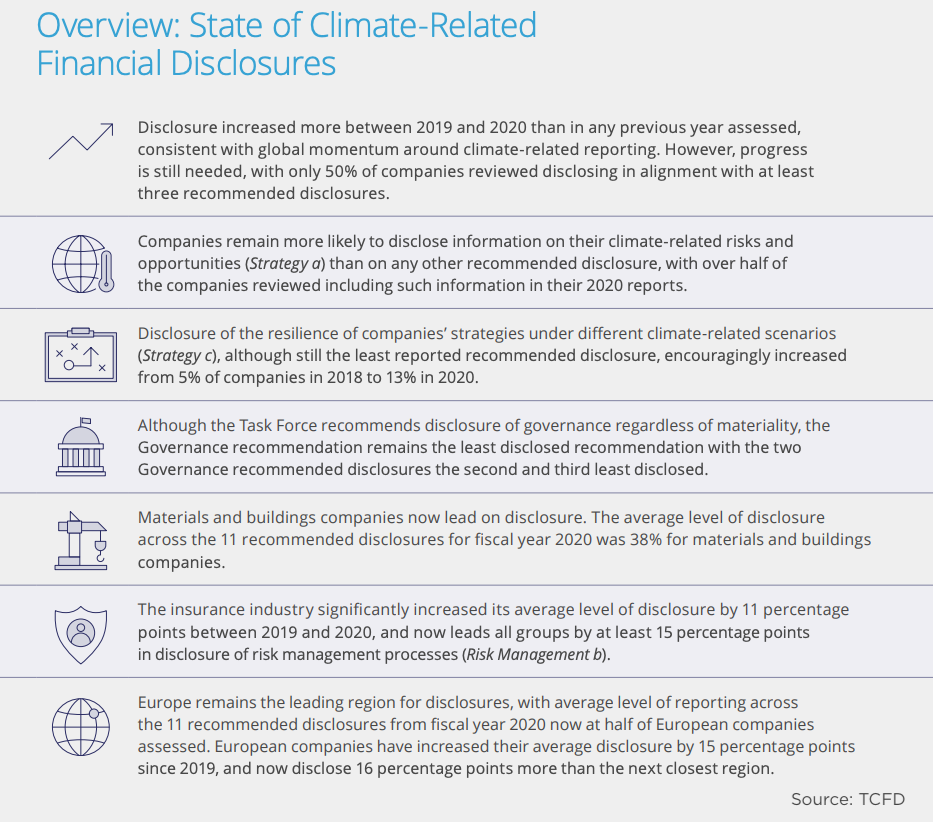

Global momentum is building in support of the recommendations, with the TCFD fast becoming the global norm for what good climate-related financial disclosure and reporting should look like. Michael Bloomberg in his opening address in the report was right to be positive about this. It is an important step in providing the consistent, comparable, decision-useful information that markets are craving on climate-related risks and opportunities.

After 15 years of CDSB asking the largest companies across the world to report on these issues and 20 years of CDP with over 10,000+ companies reporting to CDP their TCFD-aligned data in the last disclosure cycle, we might have expected a greater number of companies not just getting started on TCFD reporting, but reporting on more of the recommended disclosures, other than the indicative 50 percent reflected in the status report.

We know first-hand from conversations that many preparers are considering climate-related risks and opportunities, but have no intention of reporting them, for a plethora of reasons, until it is mandatory (and enforced). To this end the progress on national TCFD-aligned reporting requirements is welcome. Unfortunately, it has come down to the stick.

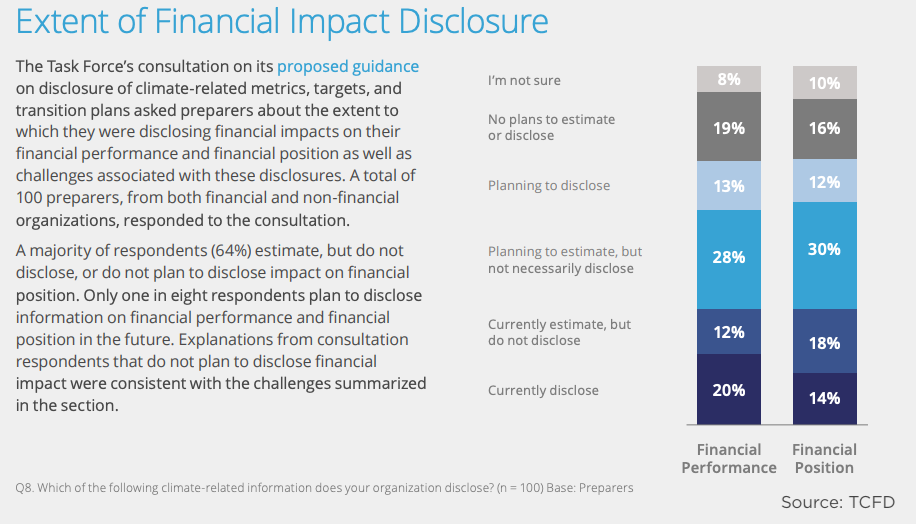

The status report notes that users of TCFD reports would find it helpful to have information on a company’s position and performance related to TCFD, with only 20% disclosing financial performance and 14% disclosing information on financial position.

The overlooked word in the TCFD acronym is “financial” – the narrative is important, but it needs to link to the back end of the annual report and accounts (balance sheet, P/L statement, notes etc). The transition to net zero will not come without a cost! There is no excuse for this not to be happening above the 14% found as part of the status report’s review. It has never been optional to report risk to markets and this shouldn’t be the case for climate (or other ESG risks for that matter). For those saying it is too hard, financial reporting isn’t simple so neither should be reporting on climate or other ESG matters. At CDSB, we do our best to have your back and to help we a have a series of publications with another due to be launched on 21 October to support reporting the financial impacts of climate using existing accounting standards which your CFO will be able to navigate.

The status report also touches on the work of the IFRS Foundation which is currently exploring setting up an International Sustainability Standards Board (ISSB), which will build upon and consolidate the work of the TCFD and the other standard setters such as CDSB as the basis for its international climate standards that we anticipate will be formally launched at COP26 in just a few weeks. This will set a comprehensive global baseline for reporting financially material climate and all sustainability topics to investors, with standards emerging via due process across the next 5 years. IFRS standards are used in over 140 countries and the increased recognition of the clear connection between sustainability and financial reporting will hopefully be the necessary kick needed to break down internal silos and help drive climate to feature on the CFO’s and board’s agenda, accelerating TCFD-aligned reporting to investors over the next 12 months.

We just have to hope that the IFRS Foundation can be more agile than ever before to fix this part of the system – the market needs good quality disclosure to allocate capital to help the transition to a more sustainable future, and time is running out to take action.

So, let’s all click our heels together 3 times and say “consistent, comparable, decision-useful” and maybe, just maybe, we’ll find our way back to a new normal.